life insurance face amount issued

United States Government Life Insurance was issued to WWI military personnel and Veterans. In 2020 the aggregate face amount of life insurance policy purchases amounted to 33 trillion US.

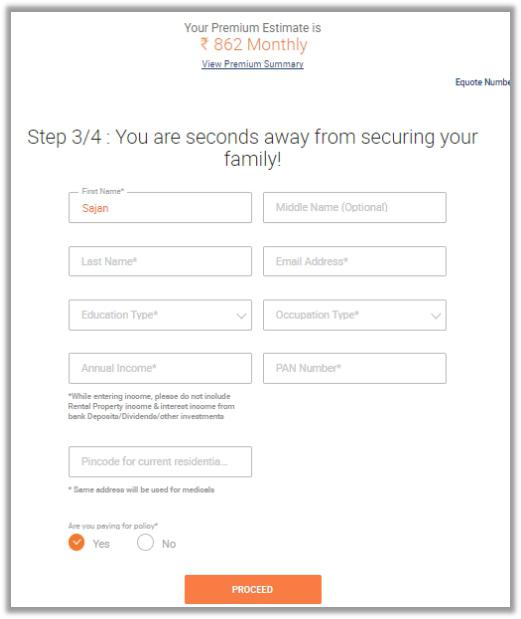

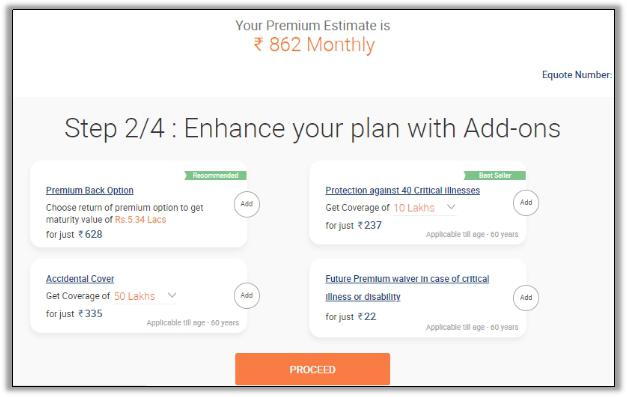

Insurance Calculator Life Insurance Premium Calculator Online Max Life Insurance

Normally the face amount is a round number like 50000 or 100000.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. Death Benefit Option Change. Dollars in the United States up from three trillion US.

Waiver of Specified Premium. Life Insurance Face Amount Sep 2021. I G 35797 ii 1000P40 29576 iii The excess of the net premium reserve over the gross premium reserve at time t1 is 9398 iv i 005 v Expenses of Premium Per.

Dollars in the previous year. A plans guaranteed issue GI is the amount of life insurance available to an employee without having to provide Evidence of Insurability or EOI. Life insurance provides financial protection for loved ones should the policyholder die.

Some of the factors that go into determining the value of your life policy include. Put You and Your Loved Ones on a Path Toward Financial Preparedness for the Future. For Guaranteed Issues Zenefits supports.

It does not include any extra benefits that might be payable under accidental death or other special provisions. When you discuss how much life insurance you need youre considering which face value is right for you. Temporary life insurance coverage.

Different GI for each enrollee type employee spouse child eg employee has 80k spouse has 40k child has 10k. Since the amount of insurance protection provided under a given policy is usually stated on the face or first page of the contract the term is commonly used when referring to the death benefit in the contract. Term life insurance is a life insurance policy that covers the policyholder for a specific term or amount of time.

The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. Waiver of Specified Premium. But as the cash value of the policy changes over time it can alter the total death benefit either above or below the face.

The overall amount has increased somewhat from 172040 in 2009. To make sure that they are financially protected in the event of your death you can purchase temporary life insurance coverage. When a life insurance policy was issued the policyowner designated a primary and a contingent beneficiary.

A 500000 policy therefore has a face value of 500000. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. The average face amount of life insurance policies in the United States in 2019 was 178150.

The cash value will be used to purchase term insurance that has a face amount. The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy. Several years later both the insured and the primary beneficiary died in the same car accident and it was impossible to determine who died first.

The face amount is the initial death benefit on a life insurance policy. There are several types of life insurance allowing consumers to find a policy type that works for their personal situation. Synonymous with permanent life insurance.

The average face value of an individual life insurance policy is 160000. Once a policy is issued an insurer may not cancel it based on a change in the policyholders health status. Face value of insurance for each administered life insurance program listed by state.

Face Amount can also be called Amount of Insurance Coverage Amount or Sum Insured. The policyholder determines the term of the life insurance policy which typically ranges from 10 to 30 years and can increase in 5-year increments. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your policy will receive the 200000 face value of your policy.

329 trillion Face amount of life insurance policy purchases in the United States 3 Stats about the cost of life insurance 5 to 15 times How much more permanent life insurance like whole life insurance costs vs. Available for insured ages 0-60. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

So if you buy a policy with a. Dollars in the United States. Premiums remain level for the life of the insured the face amount of whole life insurance is level in most cases.

The Face Amount will be paid in the event of the policyholders death or when the policy reaches maturity. Monthaversary Face decrease cannot exceed a minimum face amount of 250000. In 2018 the aggregate face amount of life insurance policies in force amounted to approximately 196 trillion US.

Ad Find the right amount of coverage for your family with SBLI Life Insurance. In a life insurance policy the amount payable in the event of death as stated on the front page of the policy. All programs are closed to new issues except for Service-Disabled Veterans Insurance and Veterans Mortgage Life Insurance.

Issued on the life of the person who has the debt debtor and the creditor owns and is the beneficiary of the policy. Currently there are over 280 million life insurance policies in force across the US. While applying for a policy you can get temporary coverage that lasts until your effective date.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Face Decrease Monthaversary. Must maintain a minimum number of insureds.

For example a policy with a face amount of 1 million will be much more valuable than one with a face amount of 100000. Fixed amounts only eg 80k. Find the right amount for your family with SBLI.

Ad Talk to a New York Life Insurance Agent to Get a Free Quote on Your Policy Today. A temporary life insurance policy offers anywhere from 50000 to 1000000 in coverage maximum. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Term life insurance is one of the most affordable types of life insurance. Data is current as of 4-30-11. All life insurance policies have a face value.

Do you have enough coverage. When a life insurance policy is identified by a dollar amount this amount is the face value. ACLI The average face value of policies does fluctuate year-on-year but theres a slow and steady growth trend.

The 20000 that remains will be collected by the insurance company. The gross premium G for a fully discrete whole life insurance with face amount of 1000 issued to 40 is determined using the equivalence principle.

Insurance Calculator Life Insurance Premium Calculator Online Max Life Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Insurance Groups Ranking For Insurance Premiums 2020 Statista

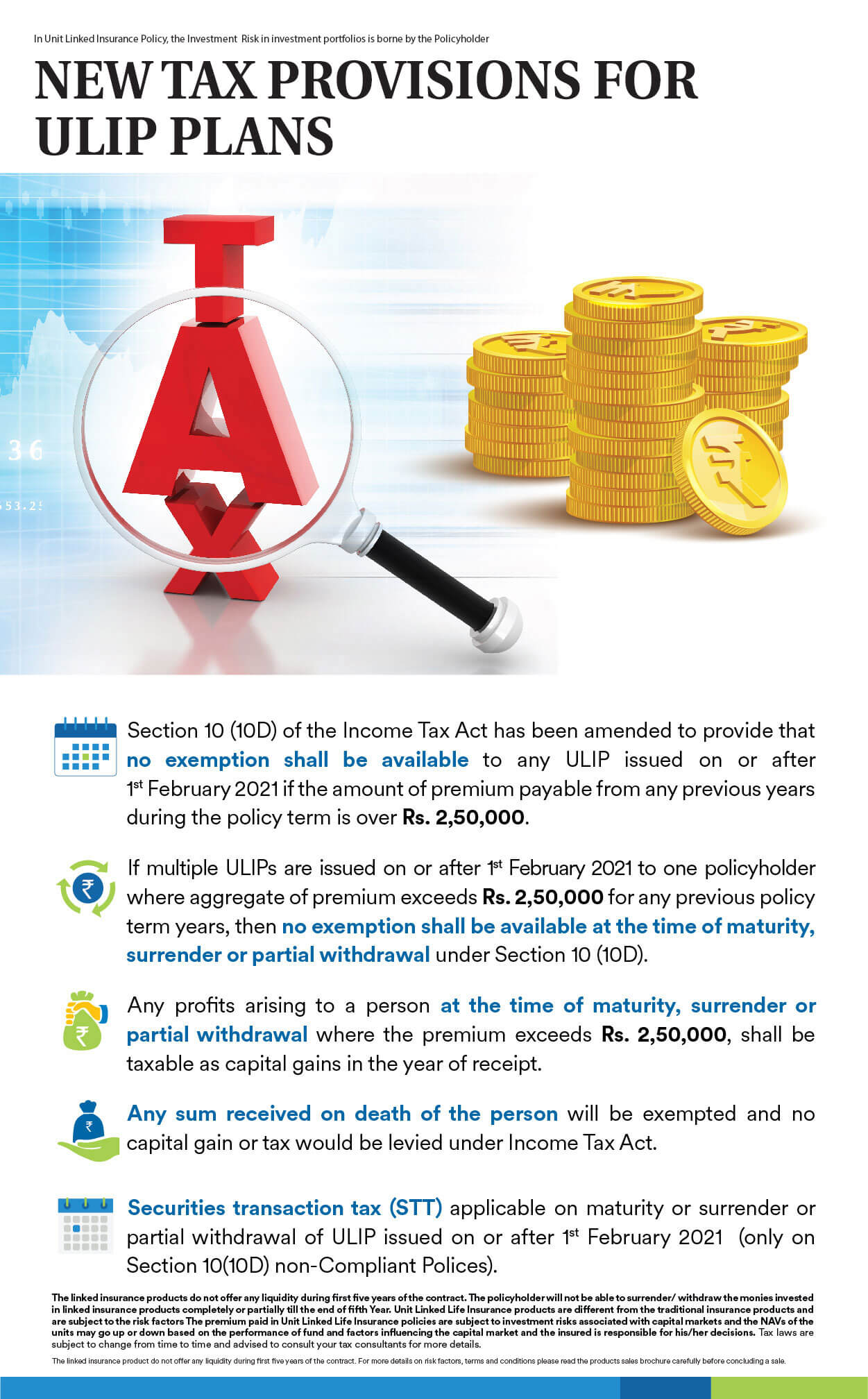

The New Tax Provisions Where Ulip Plans Will Not Be Tax Free Pnb Metlife

India New Individual Life Insurance Policies By Sector 2021 Statista

Guaranteed Issue Life Insurance Policies Fidelity Life

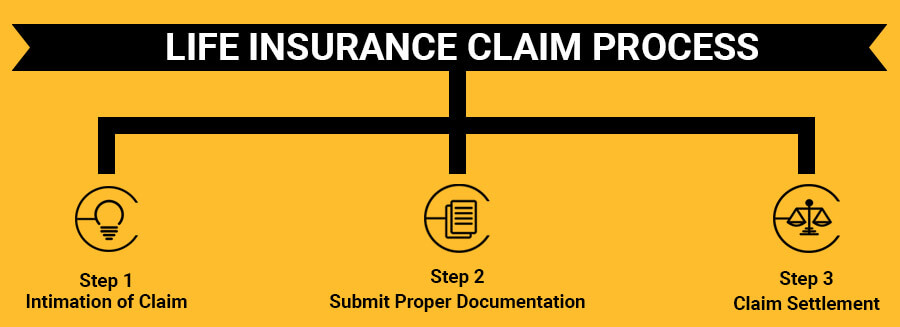

Life Insurance Claim Process And Required Documents Policyx Com

What Is Life Insurance Exact Definition Meaning Of Life Insurance

2022 Final Expense Insurance Guide Costs For Seniors

Insurance Groups Ranking For Insurance Premiums 2020 Statista